iowa capital gains tax rate 2021

The Massachusetts income tax rate for tax year 2021 is 5. There are a couple of higher rates for certain items but these dont apply in a home sale.

Iowans Here S Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About Arnold Mote Wealth Management

Printable Massachusetts state tax forms for the 2021 tax year will be based on income earned between January 1 2021 through December 31 2021.

. A capital gain rate of 15 will apply should your taxable income be at least 80000 but less than 441450 for single filers 496600 for married filing jointly or qualifying widower 469050 if you plan to file as head of household and 2483000 if you. Massachusetts state income tax Form 1 must be postmarked by April 19 2022 in order to avoid penalties and late fees. The capital gains tax is another front in the war between Eyman and Ferguson that has cost the anti-tax activist dearly.

Taxpayers facing a potential repayment may wish to unenroll from these advance payments. It also implemented advance child tax credit payments and a possibility that taxpayers may face a repayment obligation if the advance payments are too high. The state income tax rate.

In February 2021 Eyman was convicted of violations of campaign finance law and fined 26 million and barred from managing controlling negotiating or directing financial transactions for any kind of political committee. Short-term capital gains are capital gains realized from the sale or transfer of a capital asset that has been held for a year or less. For tax years beginning in 2021 the American Rescue Plan Act ARPA significantly expanded the child tax credit.

What Are The Capital Gains Tax Rates. 0 15 or 20. Indiana home sellers need to understand how these rate limits on capital gains taxes will affect their investment.

Capital gains for longer-term holdings are taxed at special rates which may be more favorable depending on your income. Unlike long-term capital gains short term capital gains are taxed at your regular marginal tax rate. Common examples include gains from short stock and security trades or flipping real estate.

Longer-term capital gains are taxed at one of three different rates.

South Carolina Property Tax Calculator Smartasset In 2021 Retirement Calculator Retirement Strategies Savings And Investment

2021 Capital Gains Tax Rates By State

Ohio Tax Rates Things To Know Credit Karma

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Capital Gains Tax Rates By State Nas Investment Solutions

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

South Carolina Property Tax Calculator Smartasset In 2021 Retirement Calculator Retirement Strategies Savings And Investment

Iowans Here S Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About Arnold Mote Wealth Management

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

The States With The Highest Capital Gains Tax Rates The Motley Fool

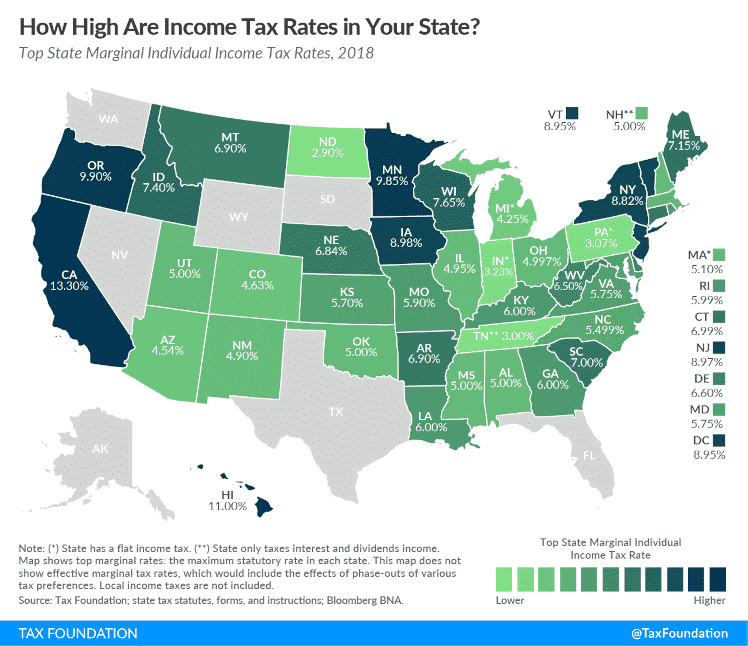

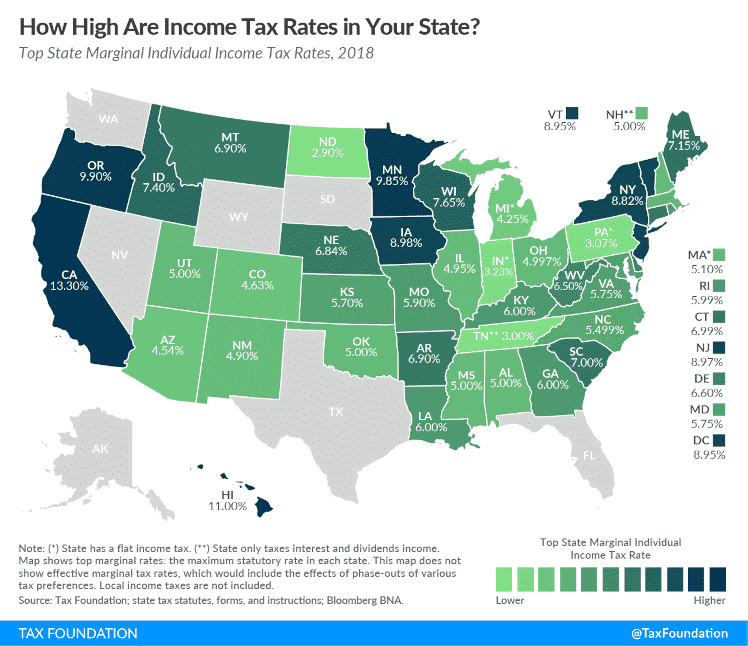

State Income Tax Rates Highest Lowest 2021 Changes

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

Iowans Here S Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About Arnold Mote Wealth Management

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

10 Most Tax Friendly States For Retirees Retirement Advice Retirement Tax

How High Are Capital Gains Taxes In Your State Tax Foundation